The state of California is now requiring any employer with more than 5 employees to sponsor a retirement plan. You will either need to fill out the exemption (because you currently have a plan) or register for CalSavers. Before registering for CalSavers please contact us to discuss your pension plan options.

Qualified retirement plans include:

- 403(a) – Qualified Annuity Plan or 403(b) Tax-Sheltered Annuity Plan

- 408(k) – Simplified Employee Pension (SEP) plans

- 408(p) – Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) IRA Plan

- 401(a) – Qualified Plan (including profit-sharing plans and defined benefit plans)

- 401(k) plans (including multiple employer plans or pooled employer plans)

- Payroll deduction IRAs with automatic enrollment

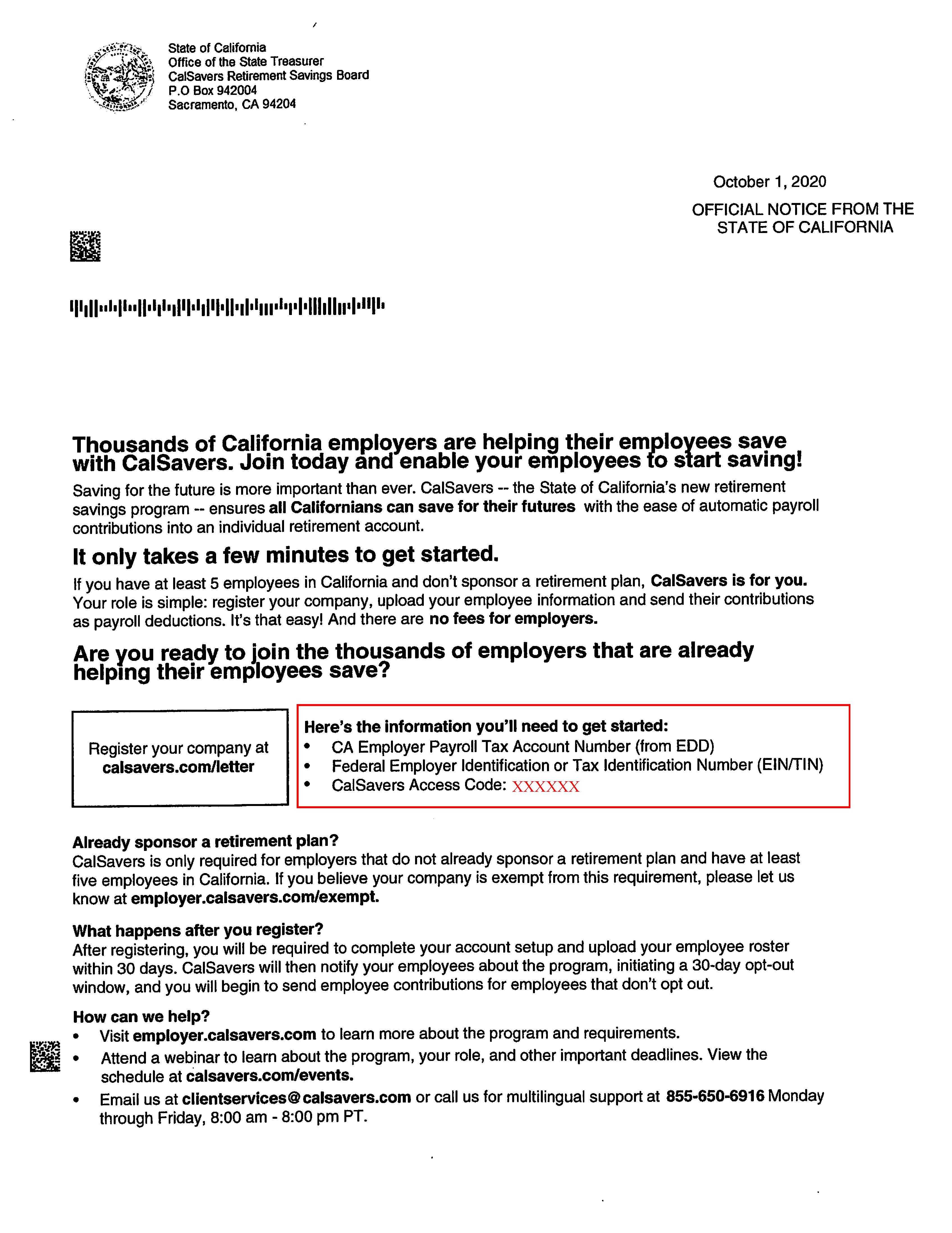

Link to fill out the exemption: employer.calsavers.com/exempt.

You’ll need the information in the red box to certify your exemption.

If you need assistance please contact our office and we’ll be happy to help.